In July, Heritage Global Inc. announced the formation of Heritage Global Capital (HGC), in what was described as a fixed asset financing services division. Joseph Upson, whose career has spanned nearly three decades, was named as managing director of the new venture. ABL Advisor caught up with Upson to find out more about HGC. In the following Q&A, Upson shares this new entity’s vision and intent.

ABL Advisor: Joe, we note the release announcing the formation of HGC mentions that this new entity will provide alternative financing solutions to businesses unable to access more traditional financing options. Please describe the risk profiles of HGC’s targeted clients and how this will differentiate the company from traditional lenders and lessors.

Joseph Upson: A majority of the clients we will be looking at will be non-bankable and many of these credit profiles will be in forbearance with banks. Essentially, we are approaching this type of business as collateral lenders. By virtue of having, internally, the support of both Heritage Global Valuations -- our appraisal group -- as well as Heritage Global Auction -- our asset recovery and disposition group -- we feel that we are well position to provide financing for transactions that are heavily collateral dependent. Additionally, our parent company provides a wide variety of services that will provide a “suite” of products for our clients. For example, Heritage Equity Partners, our investment banking division, can help them raise money, restructure debt, or find a suitable partner or buyer for the business.

While we won’t be doing deals in which there’s the potential for a day one default, in the majority of cases, we will be lending against the day one liquidation value. Of course, we will be looking at cash flows to determine whether or not the credit is going to be able to service its debt. But the added value that we bring is we can come in and be a dependable source of alternative financing, especially as it applies to credit challenged entities. That’s because we understand equipment and we know how to get rid of it, so we are able to be aggressive in lending against it.

While I’m not saying we will be overly aggressive, as asset-based lenders call on us to do a bifurcated deal, we may be a little more aggressive than most, because we feel comfortable with the liquidation strategy. In the majority of the situations we will be involved with -- especially when it comes to refinancings -- we will be structuring sale/leasebacks so that we retain title to the equipment. Working with us poses, potentially, an ideal situation for asset-based lenders because, in most situations in which we refinance assets under a lease, we will not impose covenants. In those situations, asset based lenders and borrowers will not have to worry over an additional set of covenants that does not mirror those of the working capital facility thereby potentially preventing a cross-default.

ABL Advisor: According to the announcement, HGC will be pursuing transactions ranging from $1 million to $20 million for both new equipment acquisitions and refinancings. Please tell our readers about the asset categories the group will be pursuing. Are there any primary asset categories and on the flip side, any that will be “off limits?”

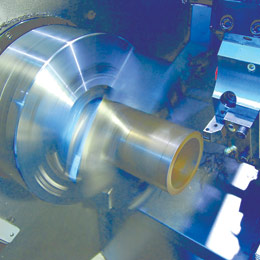

Upson: Let me begin by saying we won’t be targeting any restaurant or hospitality assets. We will target manufacturing facilities specifically focused toward certain industrial sectors. I like to call them “old economy” sectors like manufacturing … assets that have remaining long useful lives. On an independent basis –- and by that I mean outside of the manufacturing sector -- we will finance assets like yellow iron, rolling stock, rail and other heavy assets.

We will also do real estate meaning we’ll finance manufacturing facilities that are owner occupied. Those are going to be three-to-five year facilities. Since we are an auction house, we will routinely come in and auction off an entire manufacturing facility –- the real estate as well as the equipment –- and especially the equipment. We don’t have any hesitancy in doing this and we actually prefer to come into one location that houses all of the assets in which we can conduct an auction.

In short, my job will be to make sure that I structure the deals, most of which will be refinancings, against forced liquidation value from the very beginning of the deal. Most of these deals will go out for three to four years, or with a tenor that will ensure collateral coverage at all times in the event we have to liquidate.

ABL Advisor: How will Heritage Global Capital source its transactions?

Upson: I’m a banker with 27 years of experience and I have an expansive network of professionals that I’ve worked with over the years. I’ve been in the Atlanta market since 1986 and I was with Textron Financial’s asset-based lending group, so I have experience there as well. I know a number of asset-based lenders, investment bankers, turnaround consultants as well as other intermediaries. Those professionals are going to be my primary source of marketing. Heritage Equity Partners division is constantly made aware of businesses that need new financing, so we expect to see some deal flow from them as well.

As we grow, we will build out our dedicated business origination team. But for now, we are in our infancy. I will emphasize, we are going to look for opportunities to work with asset-based lenders to come in and do bifurcated deals.

ABL Advisor: What made this opportunity to launch Heritage Global Capital appealing to you after having spent so many years as a traditional banker?

Upson: This was a perfect fit for me. I’ve worked with distressed situations and now I have a situation in which I can bring my origination skills and product knowledge to structure deals in an innovative way. At Heritage Global, I have a very well-known asset valuation and asset recovery group at my disposal. These powerful tools made this an enticing opportunity to do something different.

About Joseph Upson: Joseph Upson brings over 27 years of experience in the corporate leasing and financing industry. He most recently served as Senior Vice President for Nations Equipment Finance in Atlanta. Before Nations, he was a principal at CompanionWay Capital, a senior secured lender focused on the middle-market sector, as well as Commenda Capital, a registered broker dealer focused on advisory work for small-to-middle sized companies. His diverse financial background includes strategic positions with Textron Financial, GMAC Financial, Transamerica Financial, SunTrust Bank of Atlanta, Bank of Boston and DeNovo Capital, LLC; a financial advisory and syndication firm he founded in 2002.

Upson has originated and arranged over $1.5 billion dollars in various financial instruments over his career and is well known for his capital markets expertise. His product background includes mortgage financings, sale-leasebacks, bridge loans, term loan facilities and working capital facilities collateralized by equipment and real estate.

Upson is a member of the Commercial Finance Association, the Turnaround Management Association and the Association for Corporate Growth.