The following is part one in a series in which key thought leaders at MONTICELLOAM, LLC (“Monticello”) discuss their stance on the nursing home industry. Please refer to important disclosures at the end of this article.

In a few short months, a novel coronavirus ignited a global pandemic affecting almost every aspect of daily life. With no clear indication of when, how, or if things will ever go back to the way they were, the capital markets have experienced extreme volatility as people try to assess value in the current environment.

With that as a backdrop, Monticello hosted a company-wide roundtable in which the concept of how one assesses relative value was discussed within the context of skilled nursing.

“We’re bullish on the sector because people are going to need skilled nursing, but we’re also disciplined enough to know when to put our toe in the water,” Alan Litt, co-founder of Monticello, replied when asked how investors should view skilled nursing in light of the impacts of COVID-19 and the negative portrayals of the industry in the media.

Mr. Litt went on to explain that while some rehabilitation could be done at home rather than in a medical facility as has been reported in the news, depending on the acuity of a person’s ailments or injuries, skilled nursing might be a person’s only option.

“Whether or not people can stay at home depends on acuity and comorbidity. Maybe someone with knee rehab can go to home health, but if you are sick and have other underlying issues, your kids won’t be able to take care of you. You need skilled nursing.”

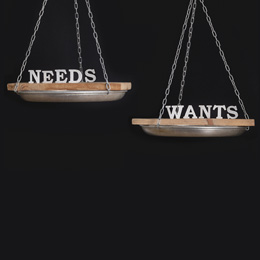

Monticello believes there exists a limit to the number of skilled nursing beds in the country, not only because each skilled nursing bed must be licensed by the state in which it’s in, creating localized supply ceilings, but also that there are underutilized assets throughout the country, making it much more difficult to financially justify building new facilities and licensing new beds. Because it is generally cheaper to renovate existing facilities and buy licensed beds rather than build new ones, Monticello contends that the supply in skilled nursing is generally stable. Similarly, because people go to nursing homes out of necessity and not by choice, demand for the product is also relatively stable, as has been backed up by evidence from market research. As stated in the Marcus & Millichap report titled Beyond the Global Health Crisis, it is believed that “the increased level of care that many aging seniors require will maintain stable demand moving forward, especially as families realize they are unable to appropriately care for loved ones during a crisis.”1

In Monticello’s view, the stability of supply and demand in the skilled nursing sector means consistency, which can be attractive during moments of extreme volatility in other markets.

1. “The increased level of care that many aging seniors require will maintain stable demand moving forward, especially as families realize they are unable to appropriately care for loved ones during a crisis.” – “Beyond the Global Health Crisis” Marcus & Millichap, Summer 2020

Important Disclosures:

The information set forth herein and any opinions contained herein do not constitute an endorsement, implied or otherwise, of any securities, nor does it constitute an endorsement with respect to any investment area of vehicle. This material is being provided to you for information purposes only and does not constitute an offer to sell or the solicitation of an offer to buy any security, financial product or instrument discussed, or a representation that any security, financial product, or instrument discussed is suitable for you. This material is not intended to provide, and should not be relied on for, accounting, legal or tax advice or investment recommendations. Investors are urged to speak with their own tax or legal advisers before entering into any investments. This material is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.

Opinions, estimates and projections in this report constitute the current judgment of Monticello as of the date of this report and are subject to change without notice. Monticello has no obligation to update, modify or amend this report or otherwise notify a reader hereof in the event that any matter stated herein, or any opinion, projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.