ABL Advisor last spoke with Monroe Capital’s President and CEO Ted Koenig in the final weeks of 2012. At the time, Koenig and his team at Monroe had embarked on a number of initiatives – from launching its healthcare finance company and an ESOP vertical to the formation of Monroe Capital Corporation. Recently, ABL Advisor learned of new set of milestones and took the occasion to spend time with Koenig who explains the far reaching and somewhat diverse nature of these accomplishments.

Koenig begins with a discussion of some current events at Monroe. “In April of this year, we completed a secondary offering of approximately 2.5 million shares for our business development company (BDC), MRCC, that generated approximately $40 million in proceeds. The offering was done on a fully accretive basis to our shareholders and priced at 106% above net asset value. I am proud of this accomplishment and the fact that in 2014 we were the number one ranked BDC in terms of total return to shareholders out of the approximate 53 publicly traded BDCs. We have built a solid public franchise, and the company has generated a safe and secure 9.5% per annum dividend to our shareholders payable every quarter since our initial public offering in 2012.”

“Our quarterly dividend is strong and dependable and is fully covered by net income … we earn about 130% of what we pay out and that puts us pretty much at the top of the class in terms of BDCs.”

All this, Koenig notes, is attributable to the depth and breadth of the Monroe platform. He says, “For one, the Monroe platform is much deeper and wider than most other BDCs. Secondly, we maintain a focus on underwriting and credit and operate with a ‘zero-loss’ tolerance. Lastly, I believe our success has a lot to do with our origination platform. We have eight direct origination offices throughout the U.S. (New York, Boston, Chicago, Los Angeles, San Francisco, Charlotte, Atlanta and Dallas) all staffed with senior deal professionals and about 12 strategic joint venture relationships with middle-market focused U.S. regional banks. Our extensive origination platform and regional bank relationships give us a significant degree of differentiation from the other private credit and BDC platforms operating in the middle-market.”

More Than Just a BDC...

But Koenig assures there is much more to the Monroe organization beyond the business development company. Koenig states, “We have almost $3 billion in assets under management and the BDC only constitutes approximately 10% of our total assets. The remaining 90% of these assets are in one of three areas: private credit funds established for institutional investors; managed accounts for specific larger and sophisticated investors; and, our collateralized loan obligation funds (CLOs).”

“For example, we recently signed up a large western state pension plan to a new $350 million limited partner commitment for a managed account that, together with allowable leverage, will give us almost $800 million of new funding capacity.”

Equally significant to Monroe’s recent growth spurt, is the completion of a $500 million limited partner fundraise for a private credit fund in 2014 that gave the firm $1.25 billion in total investable capital. “We put nearly all that money to work in 2014 and in early 2015. Today, we are fundraising for another private credit fund targeting $600 million that will give us another $1.5 billion in total funding capacity for 2015 and 2016.”

Additionally, Monroe closed on a new $412 million CLO transaction on May 29th of this year. This issuance was distinguishable in the fact that it was both U.S and European risk retention compliant –- a feat many asset managers have not yet been able to pull off. This CLO transaction follows Monroe’s previously closed $358 million CLO issuance from September of 2014, which also met U.S. and European rules in terms of risk retention.

“These CLOs are an important part of our overall platform strategy because we take our underwriting and originating best practices and bring those to our CLO platform. Our CLO investors have come to appreciate the fact that they receive the benefits of all these best practices. If you look at our returns, we have consistently been in the top decile to the top quartile in the CLO market. Again, these returns are directly attributable to the same discipline and skill set that we bring to bear in our core private credit business.”

Koenig notes that Monroe has about $1 billion of assets under management in the CLO area. “That gives us a unique insight into the overall general credit markets because with the CLO business, we receive a great deal of quantitative and qualitative information about specific companies and industries. We have nearly 250 names that we follow in a wide cross section of industry sectors in this business alone. That information flow significantly contributes to our ability in dealing with privately held middle-market businesses. Accordingly, our investor base, which consists of many state and county pension plans, universities, endowment/foundations, family offices, insurance companies, banks, European banks and pension funds and other CLO investors, all benefit from this flow of information. Ultimately, this is really what our business is all about…we maintain a proprietary information exchange on middle-market and lower middle-market companies in order to create the best possible investment opportunities for our limited partners and the best possible financing solutions for our clients and borrowers.”

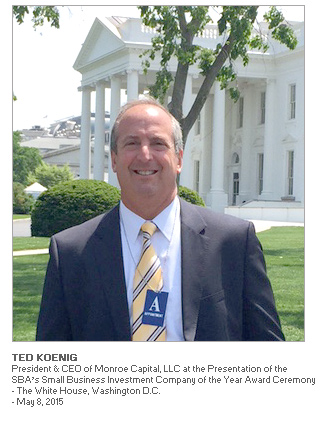

Mr. Koenig Goes to Washington

Without a doubt, May of this year brought yet another accomplishment for Koenig and the Monroe team –- this time from the U.S. Small Business Administration (SBA). Monroe was selected as the top Small Business Investment Company (SBIC) of the year for 2015 by the SBA among the 300 or so existing SBIC licensees. That honor came with an invitation to 1600 Pennsylvania Avenue in the nation’s capitol for an awards presentation ceremony. Koenig takes a moment to say simply, “Yes, that was pretty cool.”

Continued on Page 2...