A software analytics company recently concluded, after reviewing 20 million contracts submitted to it over five years by its Fortune 500 clients, its clients did not know what was in their contracts, much to their financial detriment. See: Fortune 500 Companies Losing Revenue from Inadequate Insight into Contracts

A lender may find itself in a similar position … but the ramifications could be worse because a lender’s contracts – loan agreements – represent its primary assets.

A lender frequently agrees to make concessions to its borrowers in legal documentation: guaranties are limited as to duration or amount; notice periods benefitting borrowers are increased and notice obligations on lenders are increased; other protective provisions are often limited; and often lenders agree to allow important documentation to be delivered post-closing. Failure to take account of such concessions when administering the loan can have disastrous consequences.

Moreover, lenders have post-closing monitoring obligations that can result in loss of lien priority if not met, such as the obligation to amend or replace UCC filings in the event of a name or structural change in the borrower.

A borrower can periodically decline in financial health, renegotiate contract terms or restructure itself, necessitating a review of the legal file on multiple occasions.

Perhaps software analysis of executed contracts may be expensive and not completely accurate. A more efficient solution is for a lender to capture the information in its legal files by inputting information on each document into a computer database system following the loan closing and on each subsequent occasion of a change in legal documentation (such as release of collateral or guaranties, amendment of loan agreements, or changes in the borrower’s organization).

A database system is similar to a spreadsheet but allows documents to be classified, and reports to be issued, based on a variety of criteria. The database system can hold not only data but also the documents themselves. Such a database system would be appropriately named a “Legal File Information System” (the “system” for short).

Lenders often are unwilling to devote resources to legal file maintenance because they do not consider the risks to be that great. However, would you dispense with fire insurance because you think it is unlikely your house will be damaged by fire? The expense is justified by the fact that the happening of the contingency, no matter how unlikely, cannot be tolerated.

Here are the benefits of a Legal File Information System:

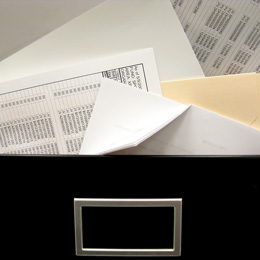

- System reports make file reviews faster and easier and consequently reduce outside legal expense since the reports will reduce the time that needs to be spent on file reviews. View an excerpt from such a report. Just as one would not expect to have a box of invoices rather than a trial balance in order to review outstanding receivables, it should not be necessary to look at voluminous legal documentation in order to get a picture of what is in the legal file.

- Once information is input into the system, it reduces the need to have counsel or others look at the actual documents so that time is saved each time a file has to be reviewed. To paraphrase the philosopher George Santayana, he who does not capture legal file information is doomed to pay for the same legal tasks to be repeated over and over.

- In essence, a legal file can be delivered to outside counsel for review simply by providing counsel with access to the system.

- System reports can be issued periodically indicating: (i) all legal documentation with a particular client; (ii) documentation that is to be provided or remedied post-closing; or (iii) documentation that has been waived due to a borrower’s financial standing that the lender might want to require should the borrower encounter financial difficulty.

- Reports can also be issued to an account executive indicating for each client, the last date of a legal review or the dates of the most recent good standing certificate, so that the account executive can gauge whether to review the client’s status in order to confirm that there have been no name or structural changes since the last review.

- The system can be set up to send Email notifications automatically to account executives as to significant events, such as the pending expiration of a guaranty or letter of credit.

- The system would let lenders search for existing counterparties when an intercreditor agreement or pay-off letter is being negotiated, so that such agreements do not need to be renegotiated if the parties to the agreement have previously agreed on a form.

- The system would let lenders search for valuable content, such as documentation relating to pledge of unusual collateral, when staff turnover and the lapse of time makes it difficult for such documentation to be identified based on naked recall.

- The system would “learn” and get smarter as time goes on because eventually, a broad variety of legal documentation will have been input into the system so that a pop-up menu of possible agreements will allow prompt entry of information and will allow prompt searching for specific documentation.

- The system can include not only information on each document but also an image of the document itself, for expedited review.

- System reports would make it easier for a lender to sell its loan portfolio since the reports will expedite the purchaser’s due diligence.

- The system could highlight crucial information in a report by use of colors and other graphical information. In the first highlighted excerpt, the status of a guaranty which is limited as to duration has been highlighted in red by the system. The highlighting is done automatically by the system based on the document’s status.

- The system could host data relating to contract amendments. If the system is populated with the agreement and paragraph number with regard to each material business rate term (such as interest rate, collection days, affirmative and negative covenants, etc.), then the amendment process is expedited since the draftsperson will immediately know which documents to review. In fact, in some cases such an amendment could be drafted based on solely on a report from the system.

Here are other important considerations:

- Database software is not expensive and can be hosted in a secure environment with concurrent access granted to staff and outside counsel (Filemaker, Quickbase and Airtable are examples). The software is “low code” or “no code,” meaning its powerful features can be implemented by clicking and dragging. A smart, computer-oriented staffer can be dedicated to this task and the participation of IT staff is not required.

- As part of the loan closing process, outside counsel can be asked to populate the system, and the time for doing so can be included in the legal bill paid by the client.

- As part of lender’s procedures to know what is in its loan agreements, outside counsel should also be asked to provide marked copies of material agreements showing the non-standard procedures. These marked copies can be accessed as part of a file review so that counsel immediately knows what concessions have been made to the borrower.

In summary, a lender can achieve significant benefits by implementing a Legal File Information System, not the least of which is reducing legal risk and outside counsel expense.